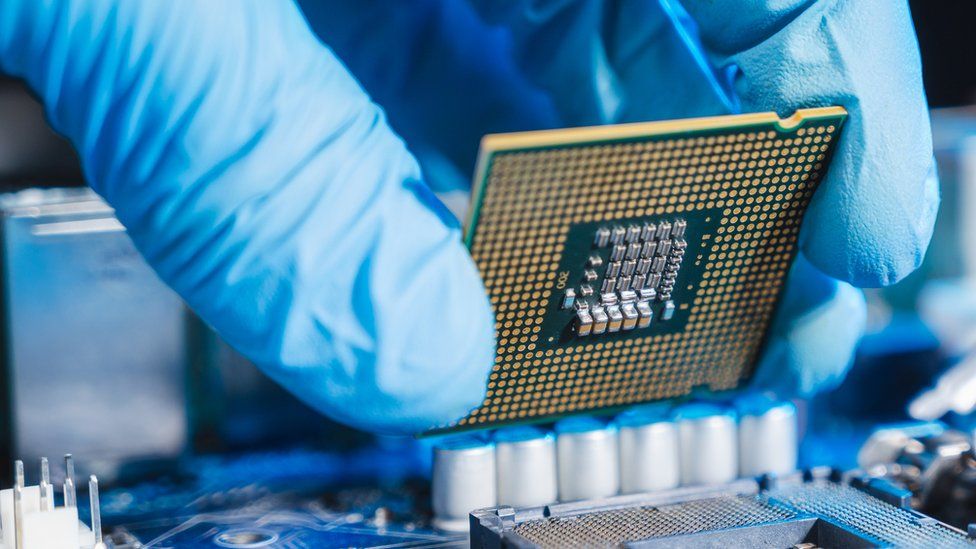

It’s wild how much power can be held in something that’s only nanometers in size, but that’s the case when it comes to the semiconductors that power the digital world as we know it today. Chips are to consumer electronics and auto vehicles what roots are to trees, fuel is to rockets, foundations are to buildings, and blood is to the human body — you get the point. It sounds dramatic, but it’s true.

Unfortunately, the COVID-19 pandemic and logistical problems led to a global shortage of chips. In the second week of August alone, automakers lowered their global vehicle productions by over 80,000 to account for a continued automobile chip shortage.

Things are looking more favorable for the global chip shortage, but there’s still a ways to go. The one company that stands to gain as the world works through this chip shortage is Taiwan Semiconductor Manufacturing (TSM -0.59%) (TSMC).Collapse

The global leader in chip production

TSMC isn’t just your typical chip maker; it’s the leader and pioneer of the chip foundry model. Instead of designing chips for mass sale, TSMC strictly manufactures chips to meet the specific needs of companies like Apple, Nvidia, and Tesla. These companies design the phones, GPUs, and cars, while TSMC creates the chips to make them come to life.

With a market capitalization of over $470 billion, it’s safe to say that TSMC has a business model that has worked for it. Still, revenue has been a bit sluggish as of late, although it shouldn’t come as a complete surprise, given the slowing demand for consumer electronics over the past year or so.

TSMC’s $15.7 billion in revenue in the second quarter was down 13.7% year over year and 6.2% from the first quarter. That’s obviously not ideal, but it seems the company’s problems have been priced into the stock, which is down over 12% in the past month.

New revenue opportunities should help the company right the ship. TSMC is aiming to grow its revenue by 15% to 20% annually until 2026.

A much-needed boost from AI opportunities

Like most big tech companies this year, TSMC has received a boost from surging AI demand. But in TSMC’s case, it won’t necessarily benefit from AI directly, but more so from increased demand from its customers. It’s a ripple effect.

Large language models that train and power AI apps require tons of data. I’m talking billions on billions of data points. It’s so much data that it cannot be stored on a few devices; it has to be stored and processed in large data centers that need advanced processing capabilities.

For these data centers to work effectively at storing and processing this data, they need the GPUs (basically car engines for computers) that companies like Nvidia make. Guess who’s one of the primary manufacturers of the chips needed to build these GPUs? Yup, I’m sure you guessed it: TSMC.

AI-related revenue is expected to be around 5% of TSMC’s total 2023 sales, but JPMorgan Chase expects it to jump to 10% by 2026. If AI fuels growth in companies like Nvidia — which JPMorgan Chase expects to be the biggest beneficiary of AI spending — TSMC should see a consistent revenue boost for quite some time.

DATA BY YCHARTS.

Growth and income opportunities

A lot of investors flock to TSMC because of its growth opportunity, but its dividend shouldn’t be overlooked. With a 2% dividend yield, TSMC is offering more than the S&P 500, which is hovering just over 1.5%.

TSMC’s dividend has fluctuated over the years, but it’s safe to say it isn’t going anywhere. The company’s free cash flow per share sits well above what it pays out in dividends, ensuring it can reward investors while also reinvesting enough in the business for growth.

That’s a combination that can contribute to a company’s longevity and a two-for-one for investors.

Our stock pickers think you can do better than Taiwan Semiconductor Manufacturing

Before you consider Taiwan Semiconductor Manufacturing, you’ll want to hear this.

The Motley Fool Stock Advisor analyst team just revealed what they believe are the 10 best stocksfor investors to buy right now… and Taiwan Semiconductor Manufacturing wasn’t one of them.

Stock Advisor is the online investing service that has beaten the stock market by 3x since 2002*. And right now, they think there are 10 stocks that are better buys.

Source : Fool